How to record income tax refunds

It’s tax season. Some lucky ones may receive a tax refund, while others will be making a payment to the CRA. Either way, you’ll want to enter this information into AgExpert Analyst, and entries will be different depending on your business structure and whether you‘re receiving from or owing to the CRA. This month’s blog will help you do these entries.

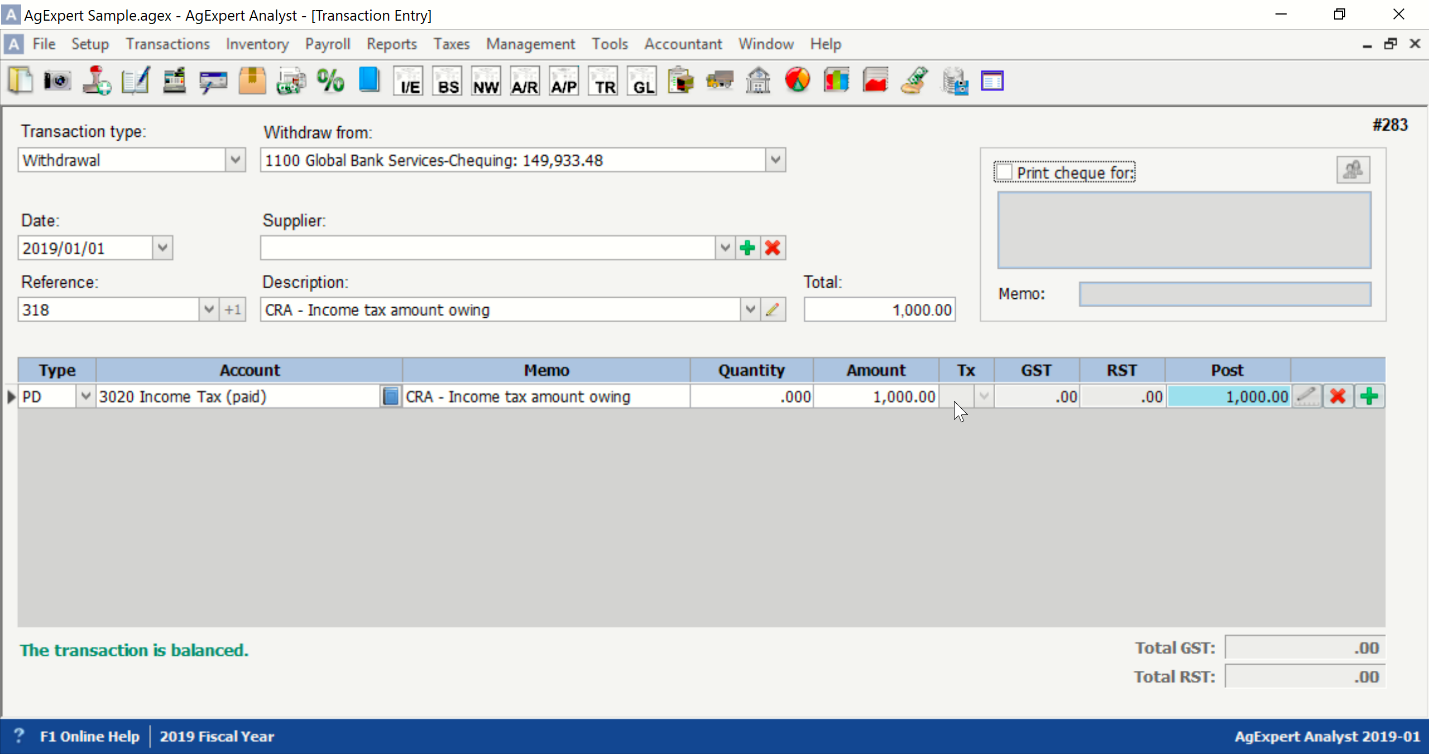

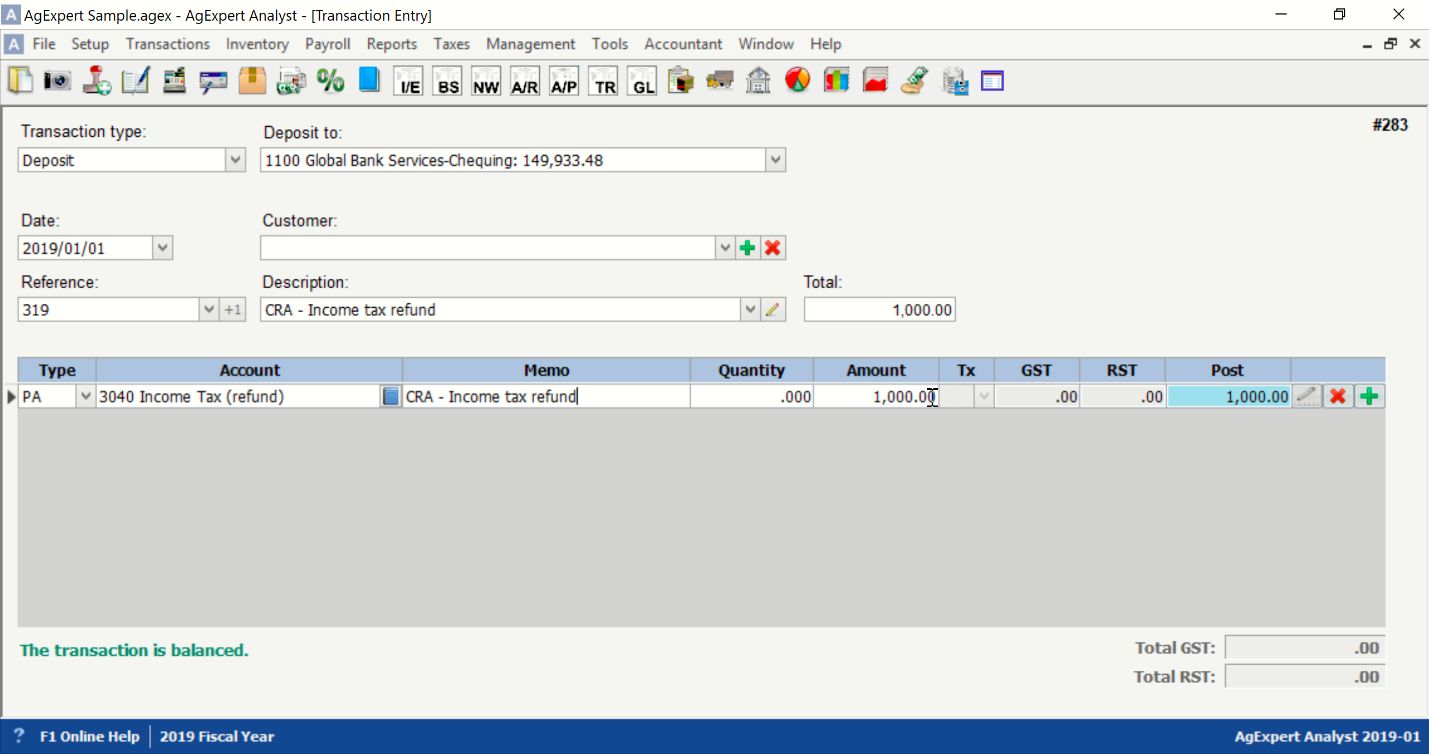

As a sole proprietorship or partnership

If there’s an amount owing to CRA, the account used should be the Income tax (paid) account, which can be found under the Personal Draw (PD) type.

If the CRA is refunding an amount to you, the account used should be Income Tax (refund), which can be found under the Personal Advance (PA) type.

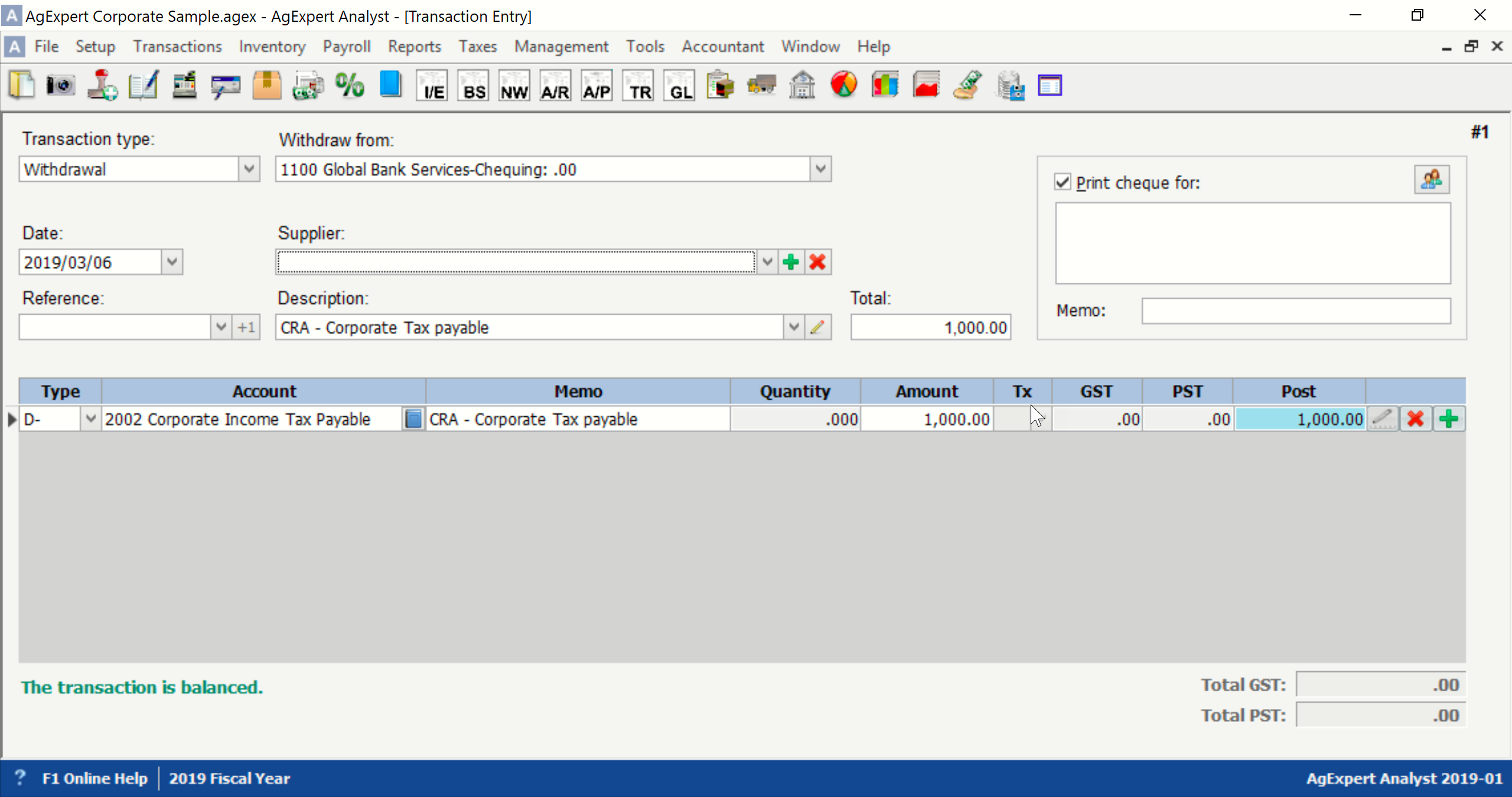

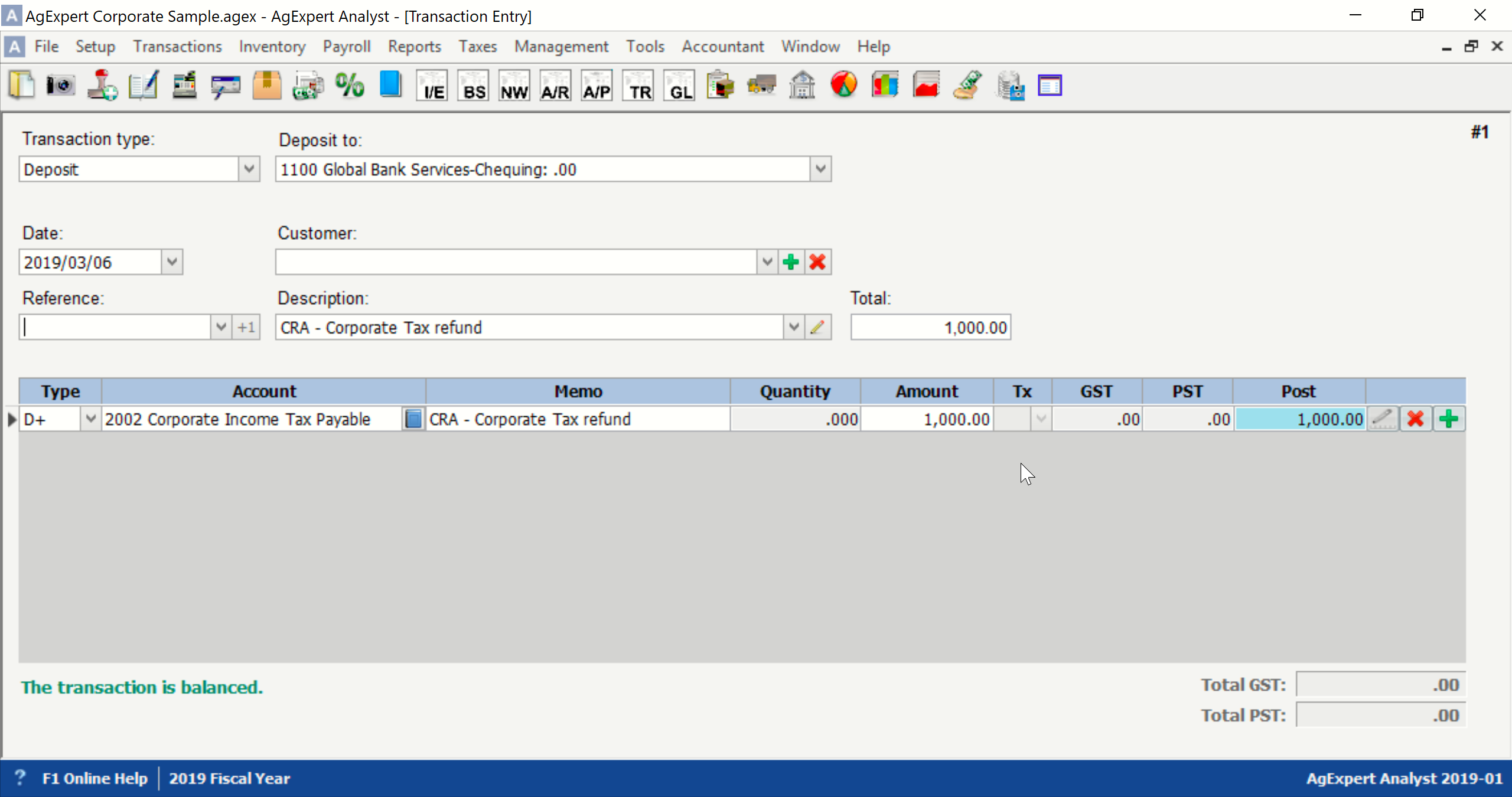

As a corporation

Corporate tax payments are recorded as a liability payment (Type D-). They should be posted to the Corporate Income Tax Payable account.

Corporate tax refunds are recorded as a liability addition (Type D+). They should be posted to the Corporate Income Tax Payable account.

Tuesday, March 19, 2019 at 10:45AM

Tuesday, March 19, 2019 at 10:45AM

Reader Comments