Transactions > Transaction examples - Transfers > Accounting for foreign currency transactions

Looking for something specific in the page and not quite sure where to find it? You can always press CTRL + F on your keyboard and type a keyword. Or you can do a search (in the top right corner).

Accounting for foreign currency transactions

Accounting for foreign currency transactions varies from country to country. In Canada, foreign currencies should be accounted for in Canadian dollars.

Producers located near the U.S. border may use a U.S. dollar bank account to manage their transactions with American businesses. If you use a U.S. dollar bank account, you must record the balance and transactions in Canadian dollars using the exchange rate on that particular day. You can access exchange rates via your financial institution or the Bank of Canada’s online currency converter.

When you set up a U.S. dollar bank account, consider setting up a primary account with two sub-accounts. You should use the first sub-account to track the balance of the U.S. account according to your bank statements. You should also create a foreign exchange sub-account to track the exchange balance to bring the account to Canadian dollars.

You’ll need to set up an expense account in AgExpert Analyst to record your gains or losses on foreign exchange.

Following are some sample transactions that you may encounter if you have a U.S. dollar bank account. This isn’t a complete list; and your situation may not match these examples.

To transfer funds from your Canadian dollar bank account to your U.S. dollar bank account:

- Select Transaction Entry from the Transactions menu. The Transaction Entry dialogue box opens.

- Select Bank Transfer from the Transaction Type drop-down menu.

- Enter the transaction Date or click the arrow to select it from the calendar.

- Select your Canadian dollar bank account.

- Enter a Reference to identify the transaction throughout AgExpert Analyst.

- Enter a Description, such as the U.S. dollar amount transferred and the exchange rate.

- Enter the total amount of the transfer. For example, if you transferred US$1,000.00 at a .9975 exchange rate, you’d enter a total amount of C$997.50

- Select Bank (BK) from the Type drop-down menu.

- Select the sub-account used to track your US balance and enter the amount transferred (US$1,000.00).

- Click (+) to add a new line and then select Bank (BK) from the Type drop-down menu.

- Select the foreign exchange sub-account and enter the difference (US-$2.50).

- The transaction should be balanced. To view it, click Recap. Click Record to record the transaction.

To record a purchase from the U.S. dollar bank account:

- In the Transaction Entry dialogue box, select Withdrawal from the Type drop-down menu.

- Select your main U.S. dollar bank account, from which you’re withdrawing funds.

- Enter a Description and the Total amount of the withdrawal.

- Select Expense (EX) from the Type drop-down menu.

- Select the applicable expense Account.

- Enter a Memo, for example, the amount transferred and the exchange rate.

- Enter the payment Amount.

- Record a new withdrawal transaction, selecting your foreign exchange sub-account to adjust the purchase to Canadian dollars.

- Enter a Description and the Total difference in Canadian funds due to the exchange.

- Select Expense (EX) from the Type drop-down menu.

- Select the applicable income Account.

- Enter a Memo.

- Enter the difference in Canadian funds in the Amount field.

Recording a sale to the U.S. dollar account:

A sale to the U.S. dollar bank account is recorded the same as a purchase from the U.S. dollar account. You must make two entries:

- one to record the sale

- one to adjust to Canadian dollars.

Re-valuing the U.S. dollar account at month-end or year-end

You’ll need to re-value your U.S. dollar bank account periodically. The best time to do this is at month-end and year-end.

Multiply your U.S. dollar bank account total by that day’s exchange rate to calculate the amount in Canadian dollars. Then record an adjustment to bring the value of the bank account to Canadian dollars. This difference will be your gain or loss on foreign exchange.

For example, if you have US$2,250.00 at the end of the month and the exchange rate is 1.0036, your total will equal C$2,258.10. If the current total of the foreign exchange sub-account is $21.37, you’ll need to make an adjustment to reduce it to $8.10, which is the current difference ($2,250.00 + $8.10 = $2,258.10).

Closing your U.S. dollar account

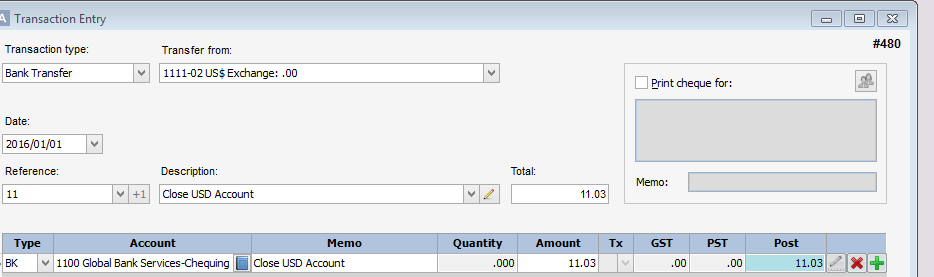

To close your U.S. dollar account:

- Re-value your account as of the day that it’s closed.

- Transfer the funds from your main U.S. dollar account to your chequing account.

- Transfer the funds in the Foreign Exchange sub-account to the chequing account.

Last updated on September 2, 2016 by FCC AgExpert