How to submit payroll files to CRA – the easy way

How to submit payroll files to CRA – the easy way.

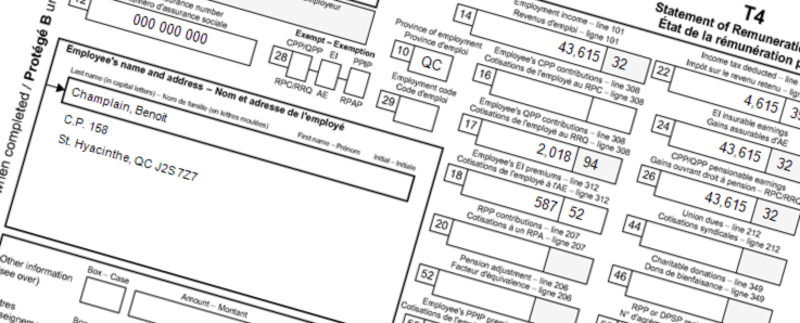

It’s that time of year again…tax time. If you have employees, there are a few things you need to know about remitting payroll information from AgExpert Analyst to Canada Revenue Agency (CRA).

As you know, T4’s are due in employee’s hands by the last day of February each year. CRA also has the same deadline for submitting the T4’s and T4 summary reports to them. You can find instructions for generating and printing your T4’s in our Knowledge Base .

As soon as you’ve entered your last paycheque and sent in the final remittance, AgExpert Analyst has your T4’s ready to go. From here, you have two options for submitting your payroll files to CRA – online or by mail.

Submitting payroll tax forms online

Mail is no longer the only option or even the best option. CRA and Revenu Québec allow employers to upload year-end payroll reports directly through their websites, which can speed up the process immensely.

If you wish to file your forms electronically, it couldn’t be easier. AgExpert Analyst will create an XML file that is accepted by both agencies. Simply check the box to create an XML file in the Report Console window. The program will allow you to preview your forms on the screen before creating and saving the file in the location of your choice.

To submit the file to CRA, you will need to obtain a web access code here . To submit to Revenu Québec, you will need to register with clicSÉQUR. Note that the clicSÉQUR service is only available in French, but most web browsers can translate to your language of choice.

After you’ve gotten your credentials ready to go, sign in to the electronic submission service using the links below.

Submit T4’s to CRA

Submit RL-1’s to Revenu Québec

Submitting payroll tax forms by mail

To submit your payroll by mail, print your reports and forms, sign and mail them to CRA at:

Ottawa Technology Centre

875 Heron Road

Ottawa, ON K1A 1A2

If you are an employer in Quebec, you will also need to file the RL-1 and RL-1 Summary forms by the same deadline. You can find instructions for generating and printing your RL-1’s in our Knowledge Base.

If you live in Québec, print your reports and forms, sign and mail them to Revenu Québec at:

Revenu Québec

C.P. 6700, succursale Place-Desjardins

Montréal (Québec) G1A 1B6

Note: If you are in Montréal, Laval, Laurentides, Lanaudière or Montérégie, mail your forms to:

Revenu Québec

3800, rue de Marly

C. P. 25666, succursale Terminus

Québec (Québec) G1A 1B6

Wednesday, February 8, 2017 at 2:40PM

Wednesday, February 8, 2017 at 2:40PM

Reader Comments