How do you pay employees for statutory holidays?

As an employer, figuring out how to pay your employees for statutory holidays can seem like a tall order. Who’s eligible? How much they are entitled to? The payroll module in AgExpert Analyst handles the bulk of your payroll calculations, but stat pay will require some manual work. Here’s a quick guide for you:

Know the rules for your province

In most provinces, producers are exempt from paying stat pay. In exempt provinces, producers may still choose to pay stat pay. If you're unsure what your obligations are, check with your accountant or call your local labour standards branch.

British Columbia – 1-800-663-3316

Alberta – 1-877-427-3731

Saskatchewan – 1-800-667-1783

Manitoba – 1-800-821-4307

Ontario – 1-800-531-5551

Quebec – 1-844-838-0808

Newfoundland and Labrador – (page 14 ) 1-877-563-1063

Prince Edward Island – 1-800-333-4362

Nova Scotia – 1-888-315-0110

New Brunswick – 1-888-452-2687

Yukon – 1-867-667-5944

Northwest Territories – Check out page 21 of the Employment Standards FAQ PDF 1-888-700-5707

Nunavut – 1-877-806-8402

Here’s an example of how to calculate stat pay in Saskatchewan

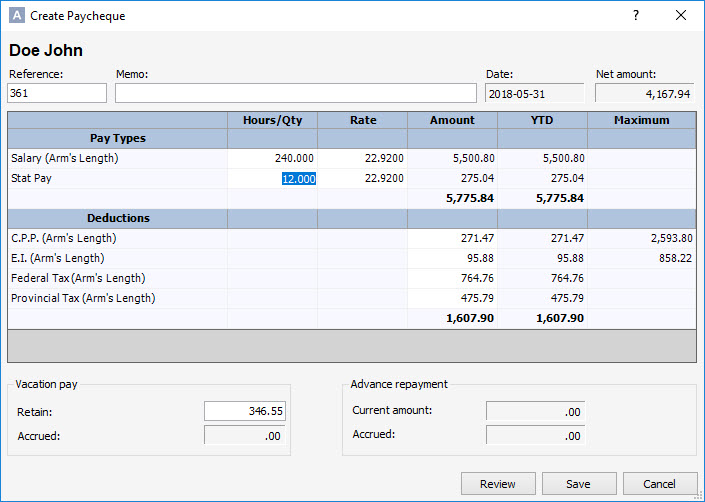

Let’s say John Doe makes $1,375.20/week. He is paid monthly and a stat holiday falls within the current pay period. To calculate John’s stat pay, we’ll use this calculation:

Regular wages: $1,375.20 x 4 weeks = $5,500.80

Stat pay = Total earning divided by the number of days worked

Full-time employees work 5 days every week.

$5,500.80 divided by 20 = $275.04

Essentially, we’re figuring out his average daily wage, or if you prefer, his average daily hours.

How to setup stat pay in AgExpert Analyst

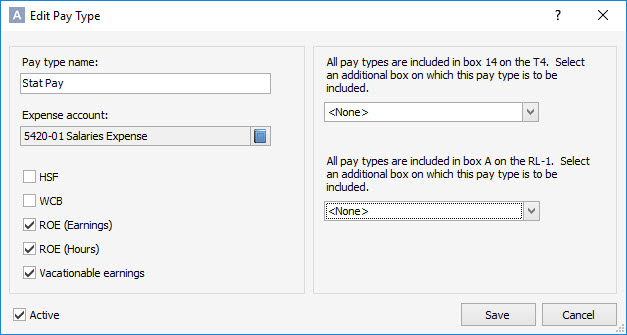

- First, go to the Payroll menu and select Setup. In the payroll setup screen, click on Pay Types. Select Add and enter the information for Stat Pay. Save your changes.

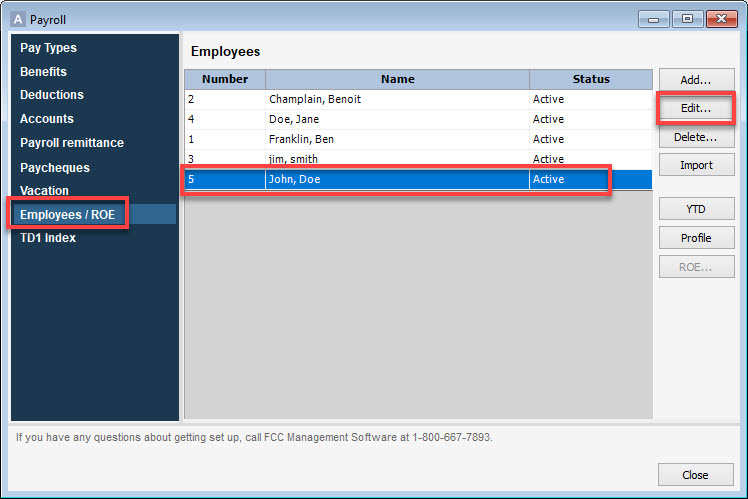

- Now you’ll add the stat pay to your employee. Go to Employees/ROE, highlight your employee and click Edit.

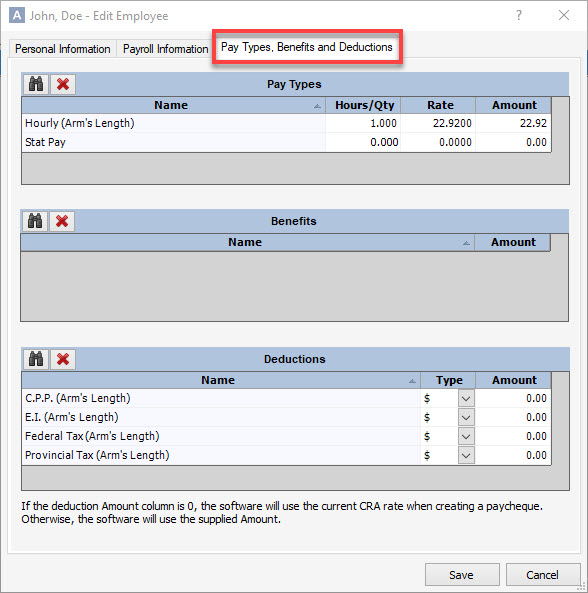

- Next, select the Pay Types, Benefits and Deductions tab. Click on the binoculars to the left of Pay types and select Stat Pay. If your employees are paid hourly, type in the average hours on the stat pay line. If they have a salary, leave it at zero. Save your changes.

- To pay your employees stat pay, go to the Payroll menu and Create Paycheques. Enter the payroll information as usual. When paying stat pay, enter the average hours worked and the rate at which they’re paid.

Tuesday, May 15, 2018 at 2:17PM

Tuesday, May 15, 2018 at 2:17PM

Reader Comments