Published Oct 12,2021

Who has access to your AgExpert data? Is your personal information secure? How do you know? Is there anything you can do? Well, yes. And we can help too.

How does AgExpert protect your data?

We take data protection seriously. AgExpert releases frequent updates for all products to stay on top of various system requirements. Before signing in to Field or Accounting, check our policy agreements at the bottom left of the sign-in page. These documents lay out our commitment to everyone who creates an account: our privacy policy, terms of use, security and data use terms.

We know where your data is always located, and we treat it with integrity.

OK, but are there any guarantees?

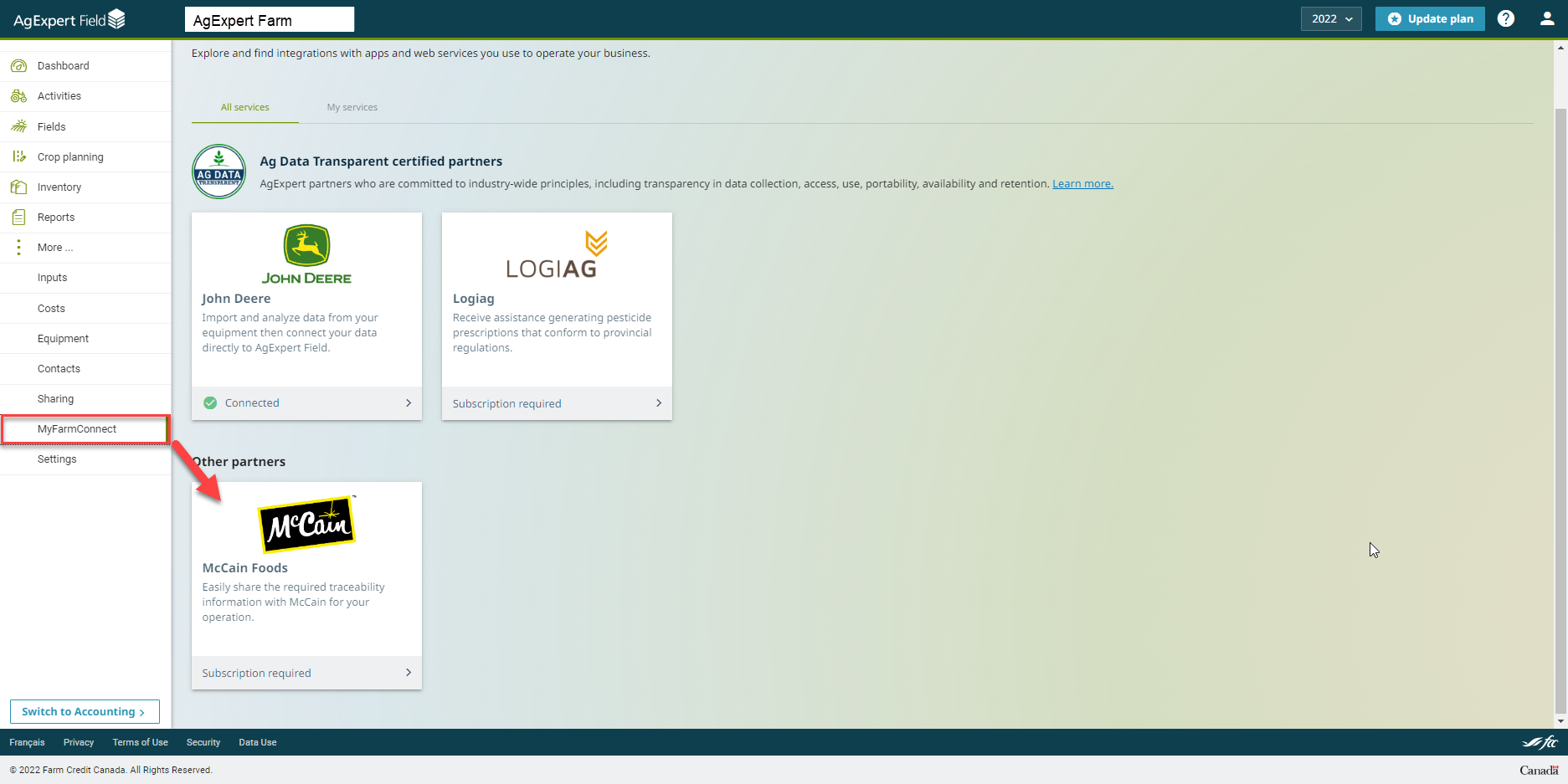

Absolutely. In 2018, AgExpert became the first Canadian company to receive Ag Data Transparent (ADT) certification.

This rigorous process includes 10 detailed questions about ag data ownership, use, portability and security. ADT audits AgExpert to ensure we adhere to the terms of use that we agreed to. It’s a commitment that we take seriously. Your trust matters.

AgExpert does not share your data with anyone. You are the only one who can choose to share your data with your trusted partners.

What can you do to secure your account?

You own your data. Be mindful whenever you navigate the internet and only signup to reputable websites.

Share your account, not your password

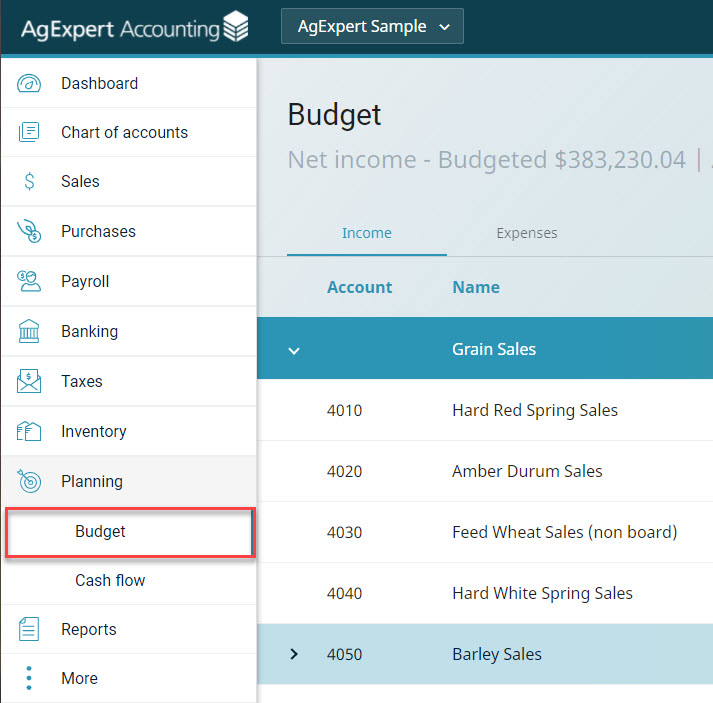

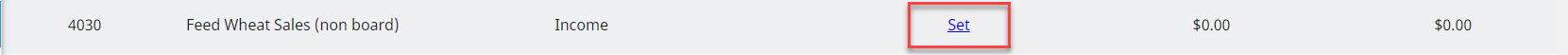

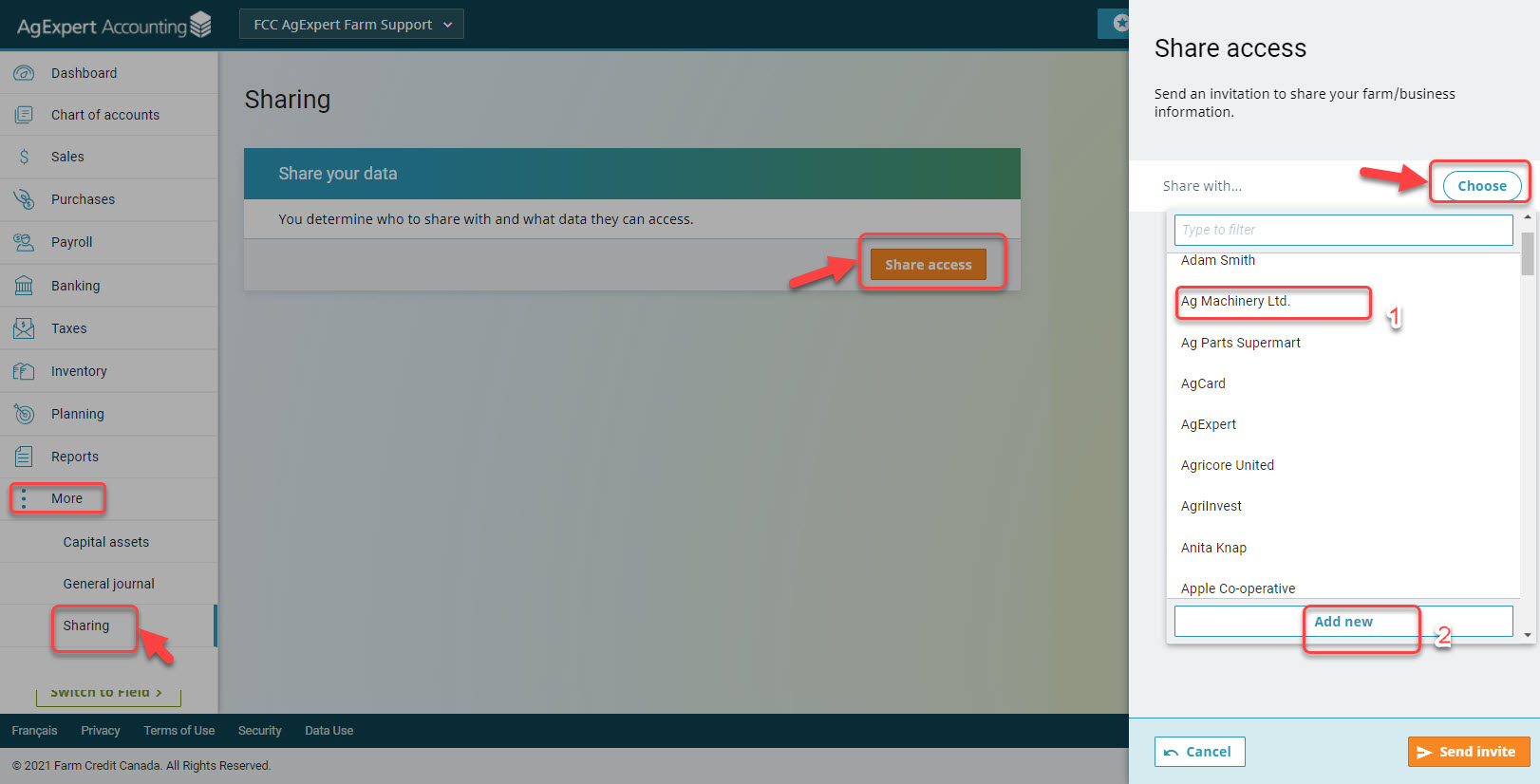

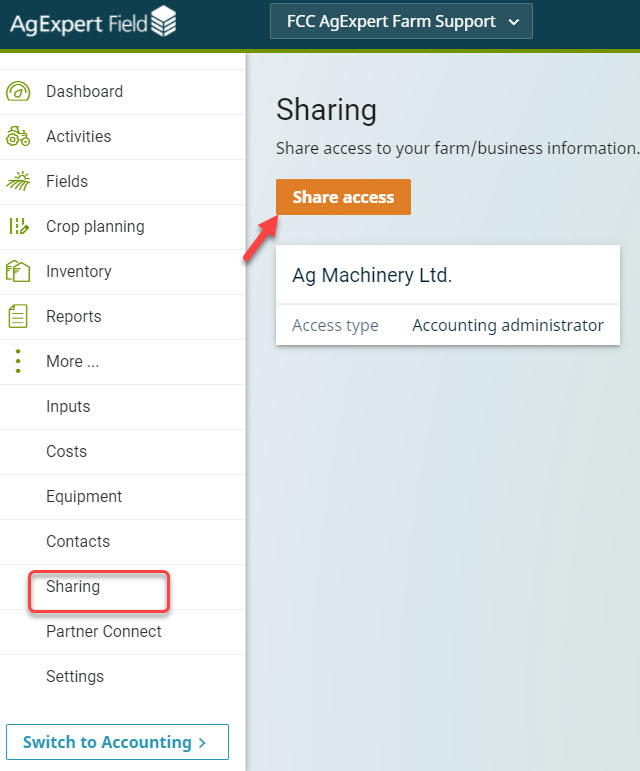

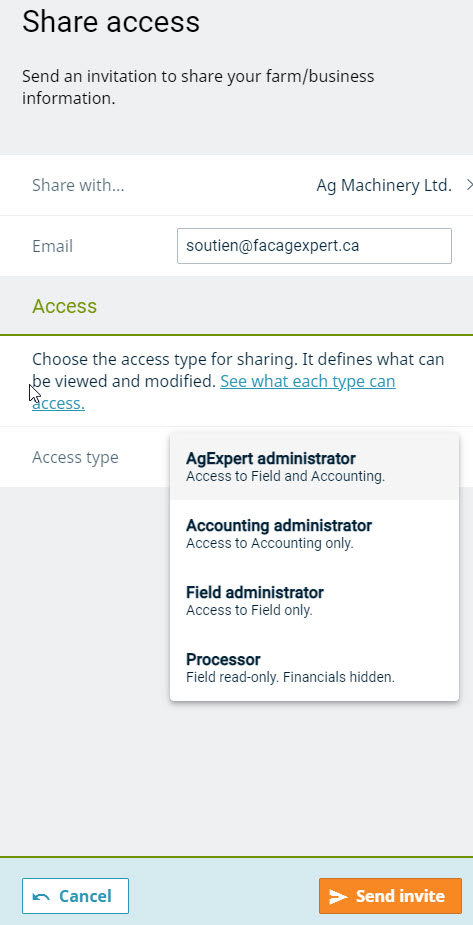

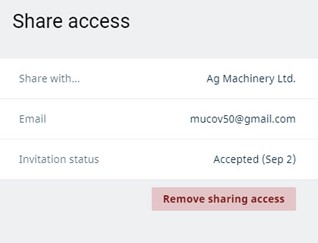

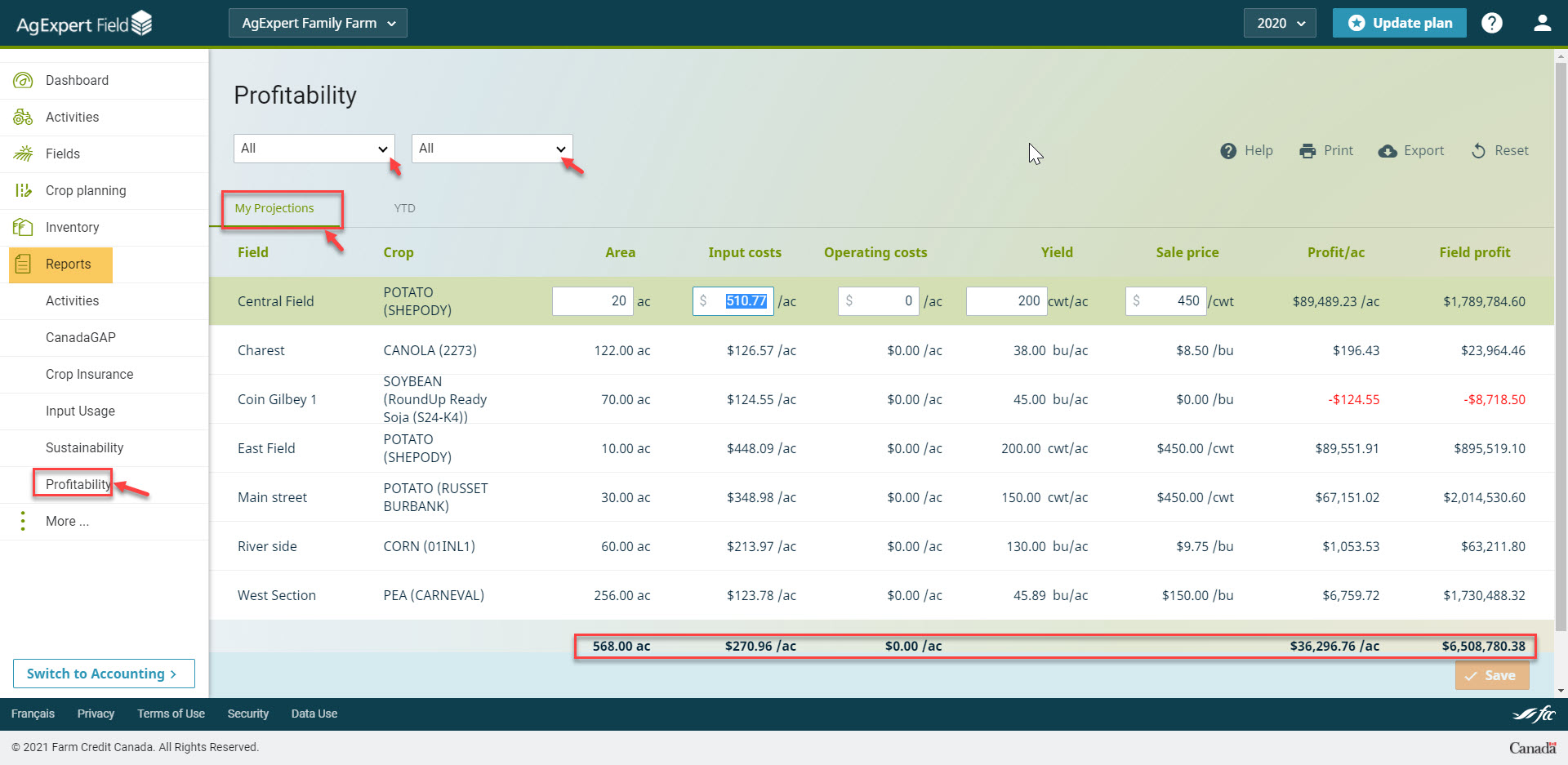

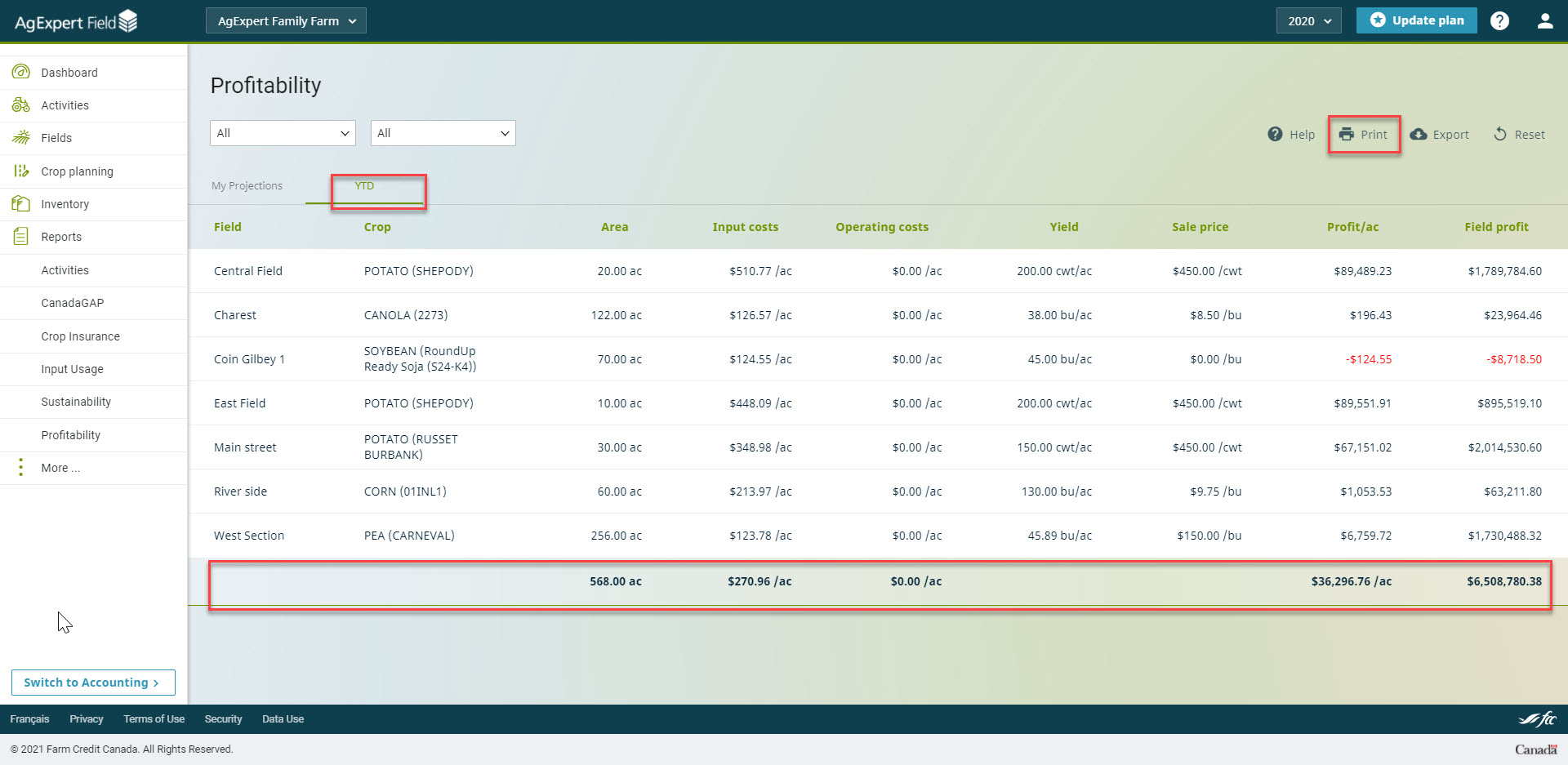

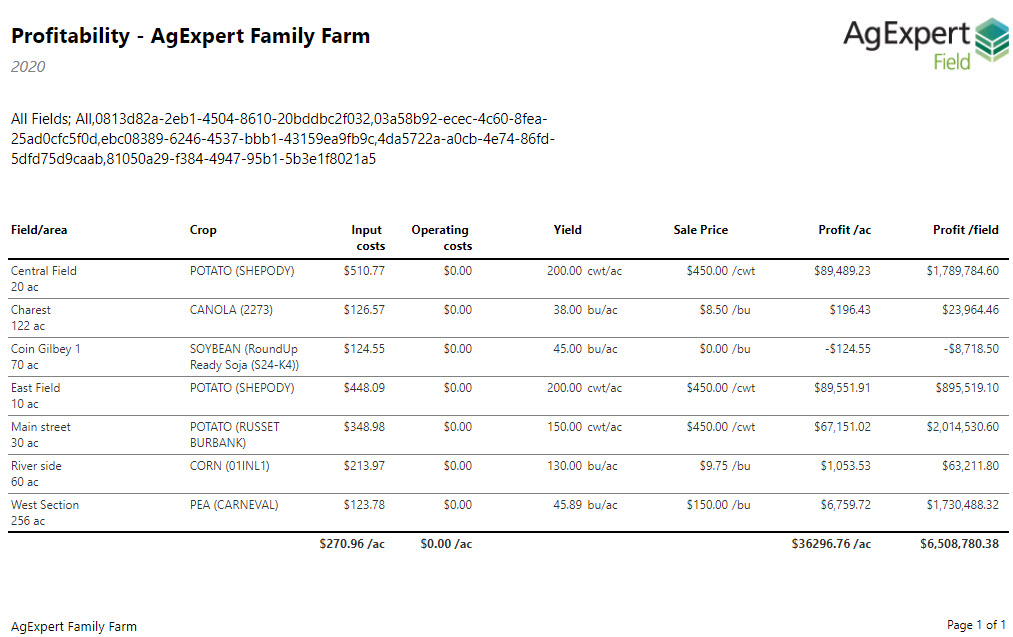

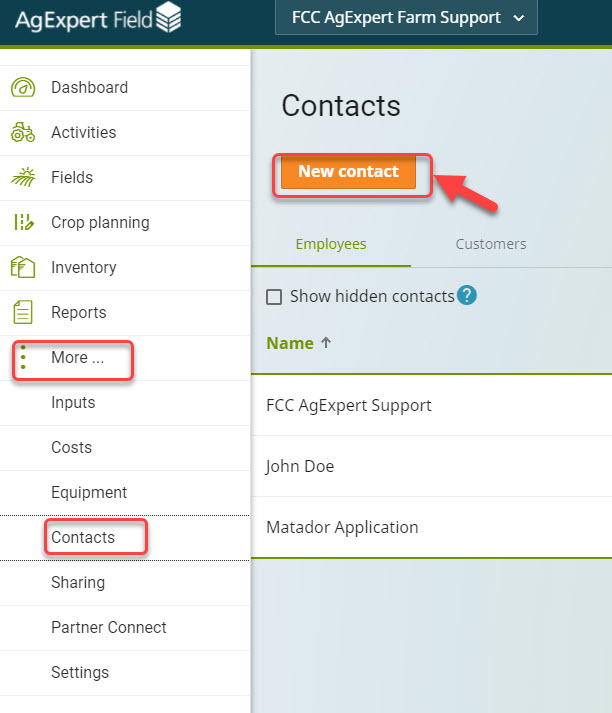

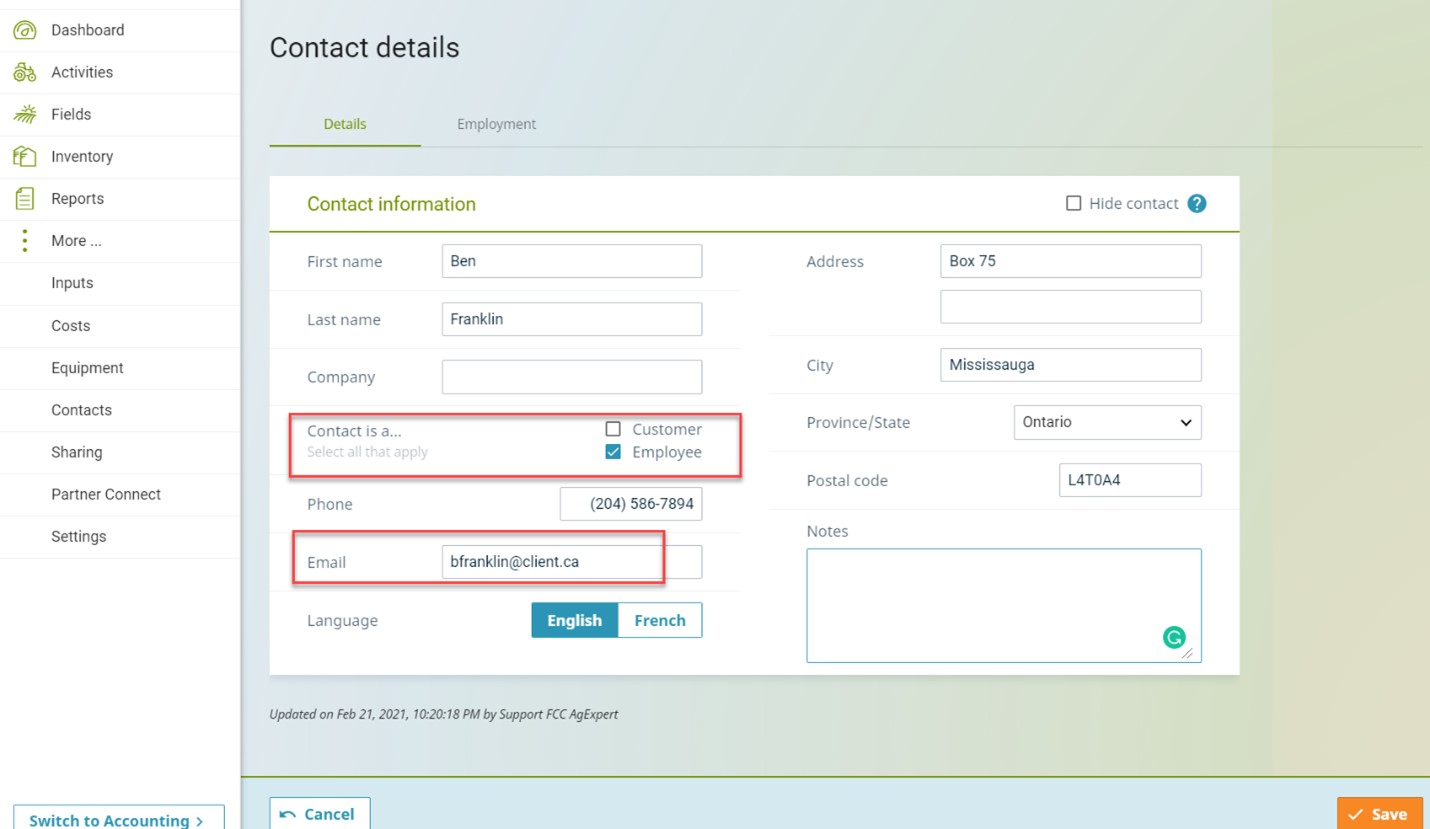

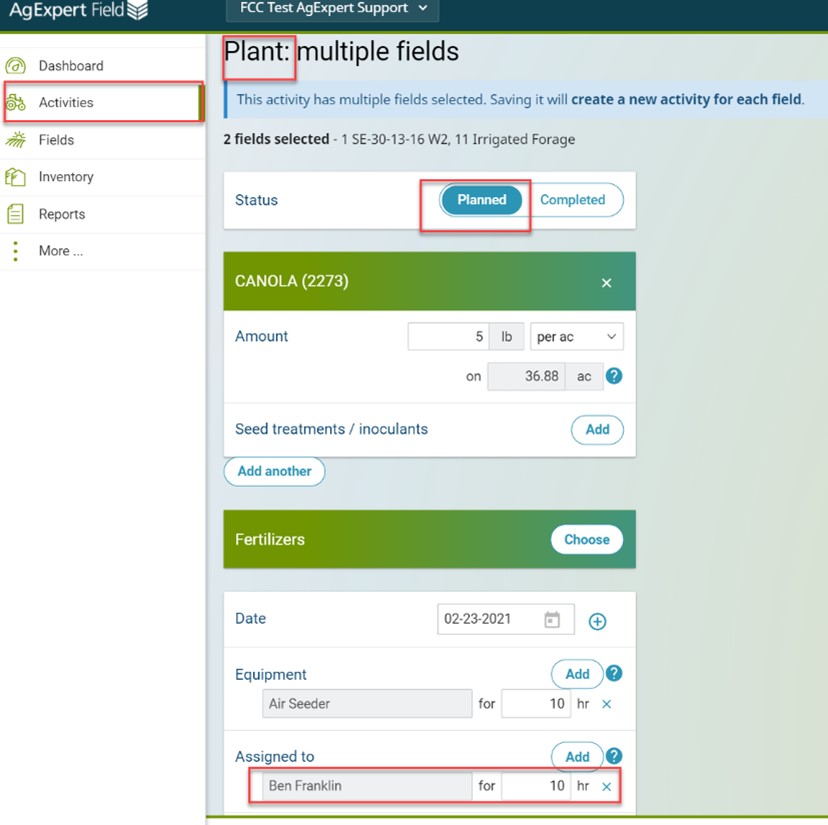

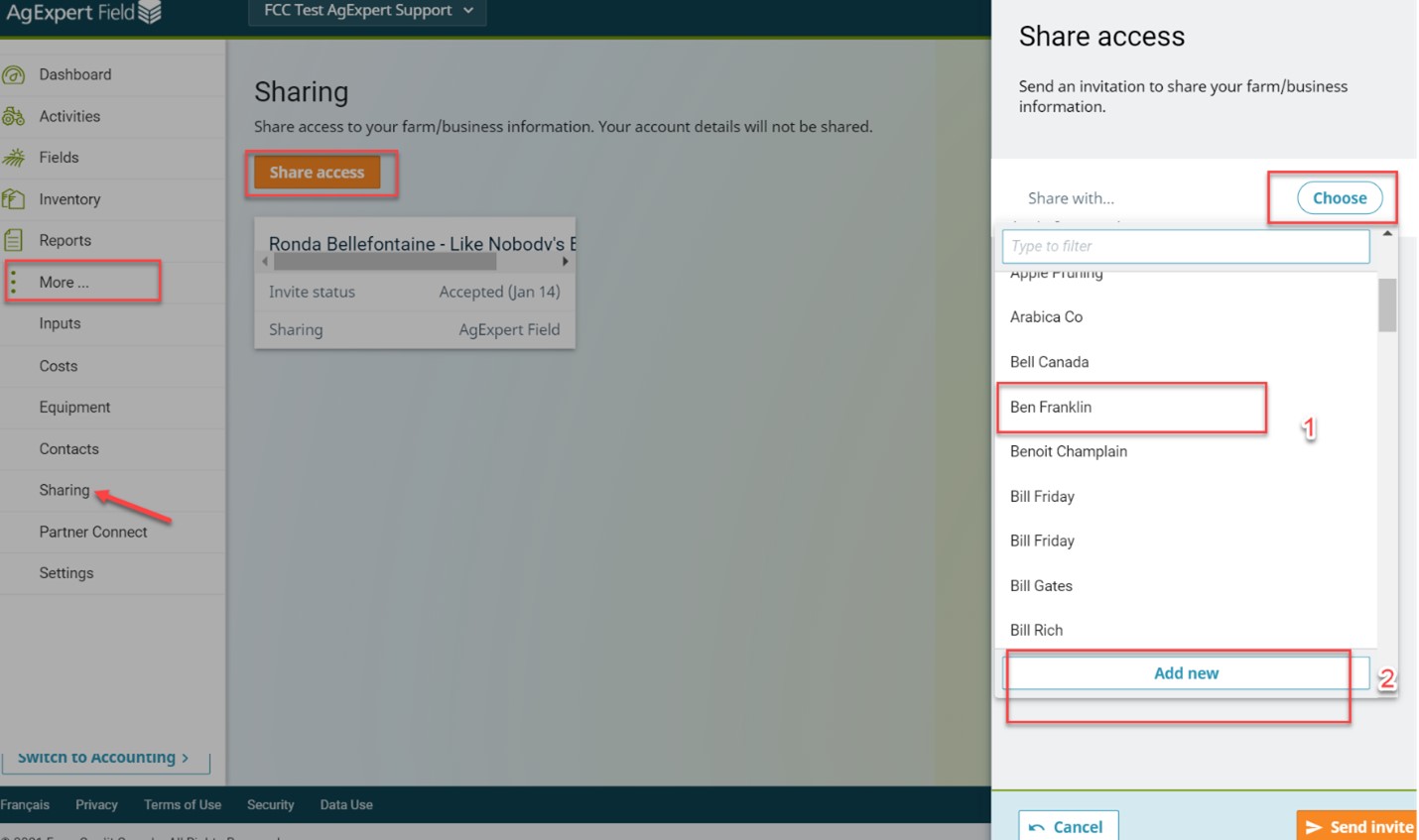

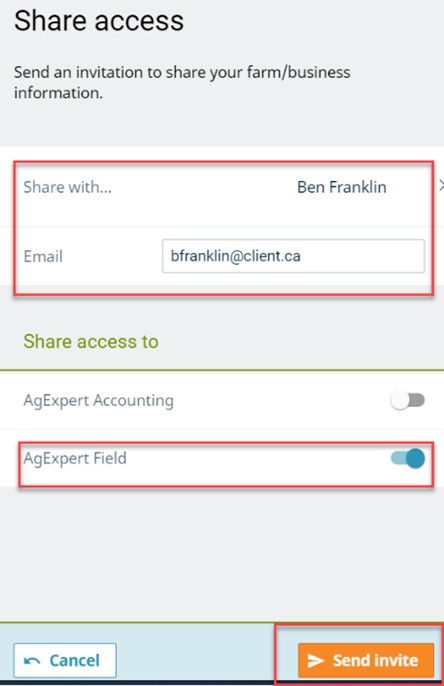

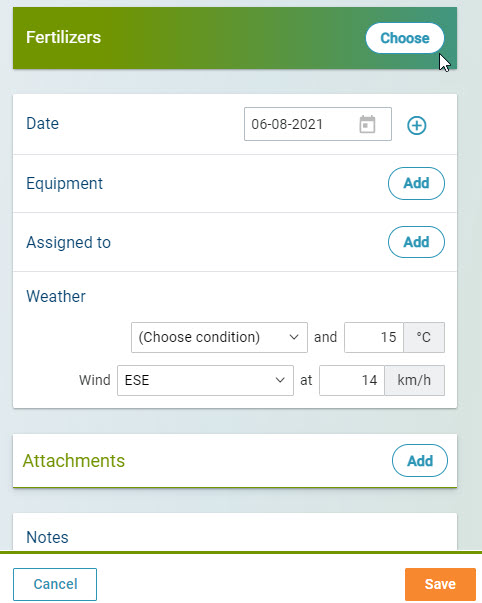

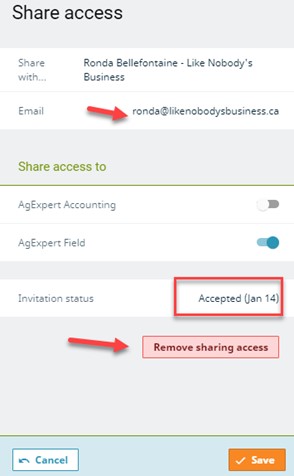

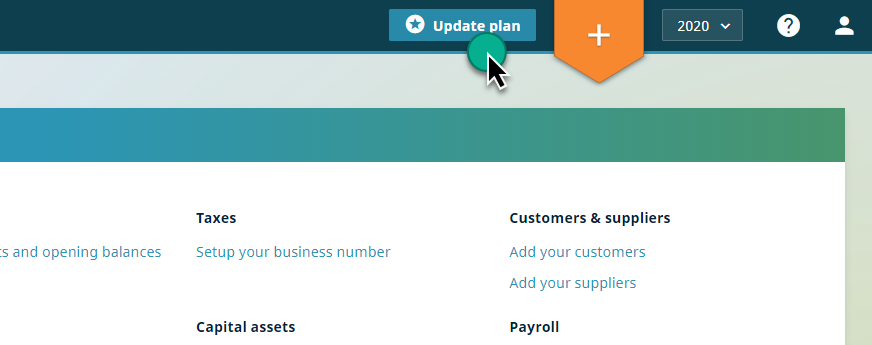

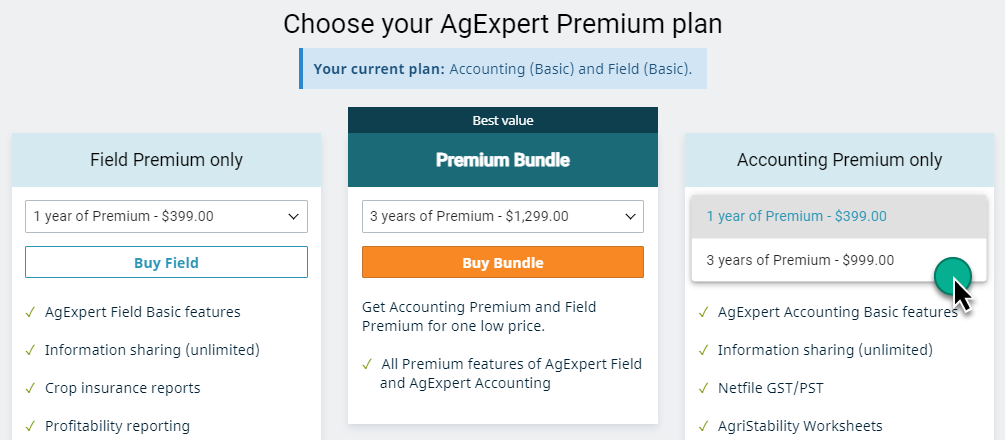

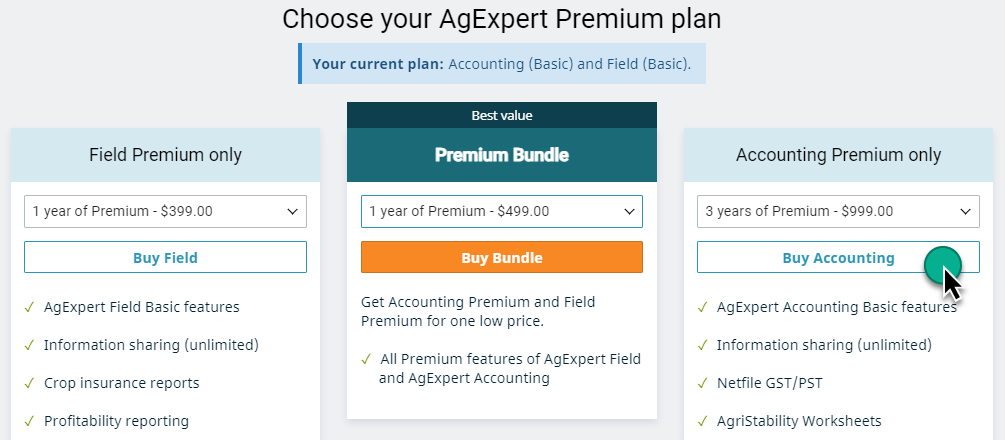

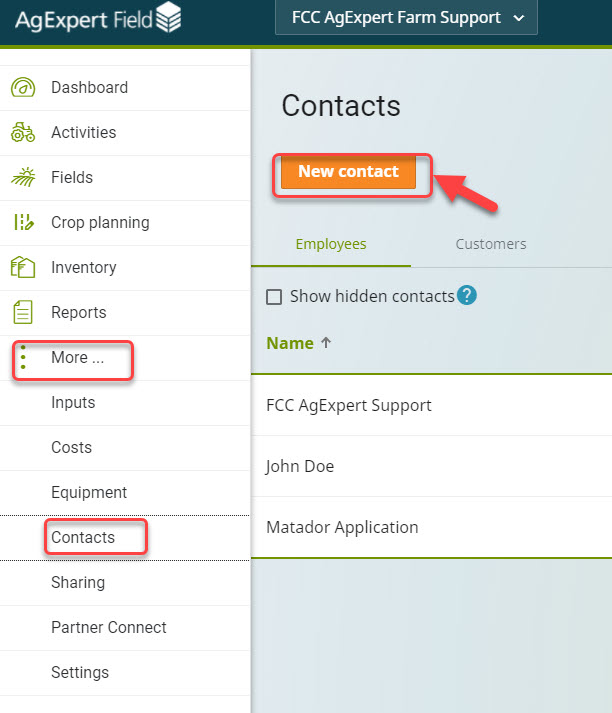

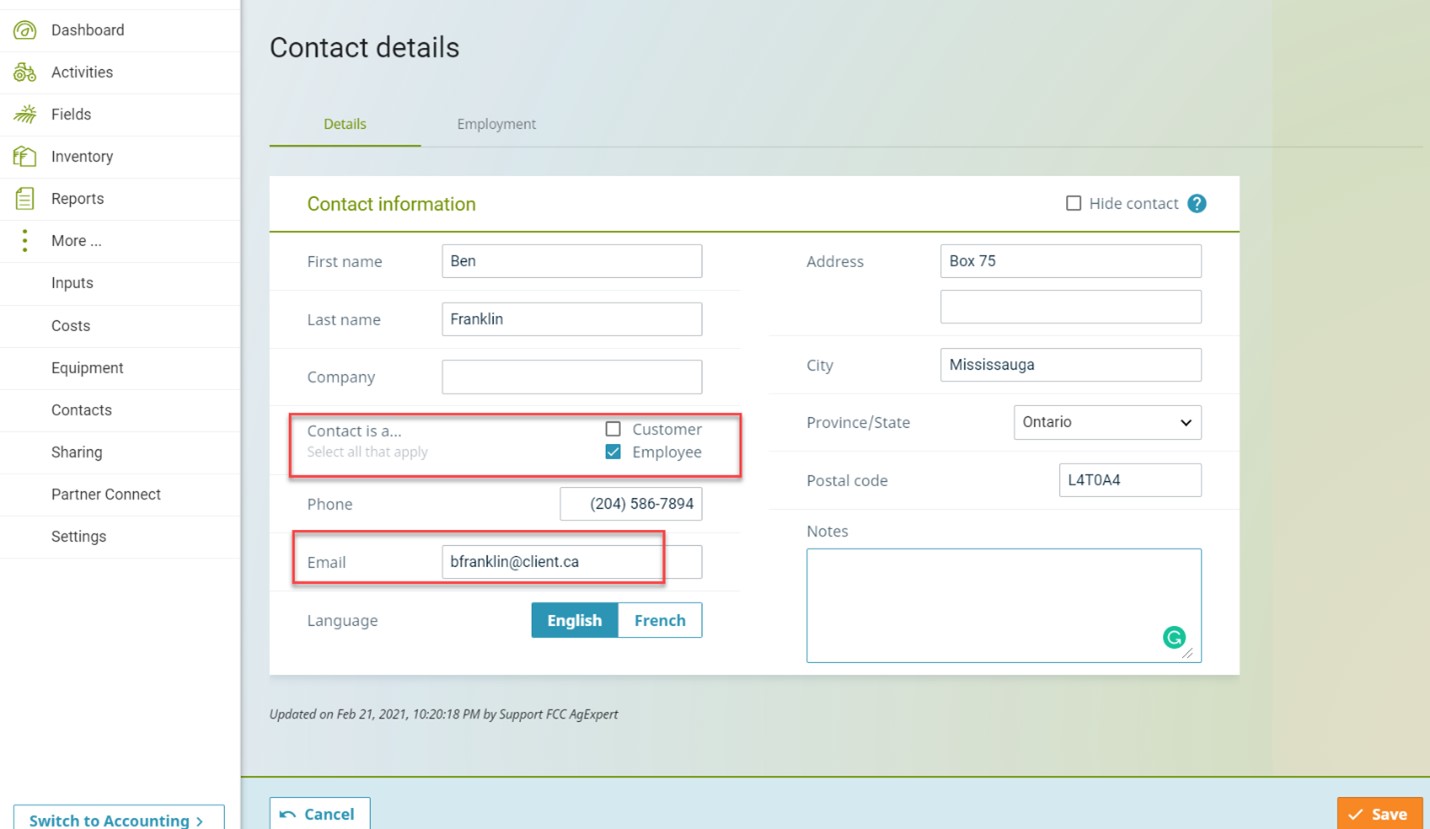

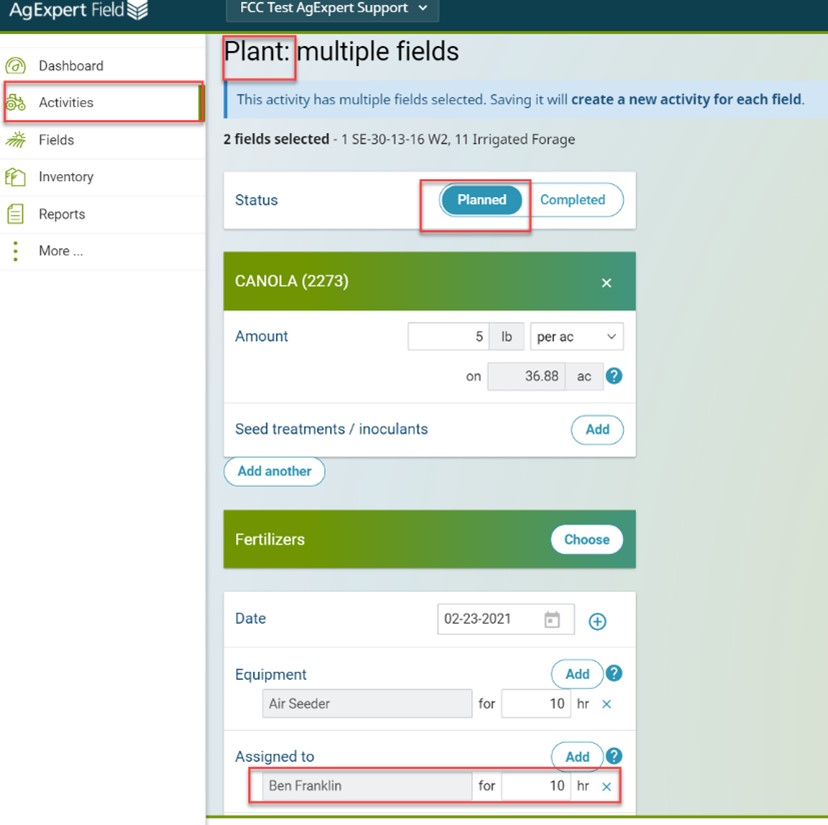

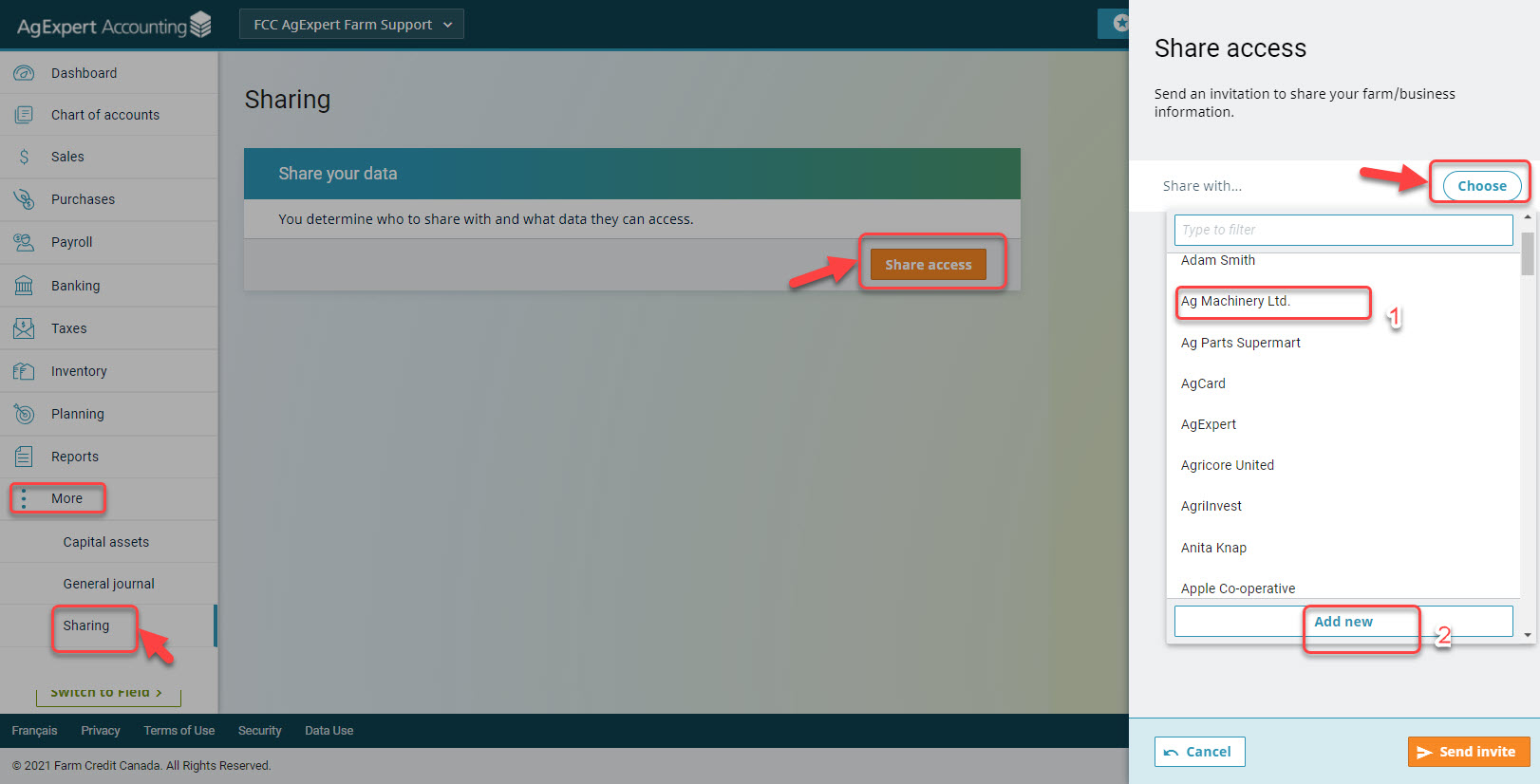

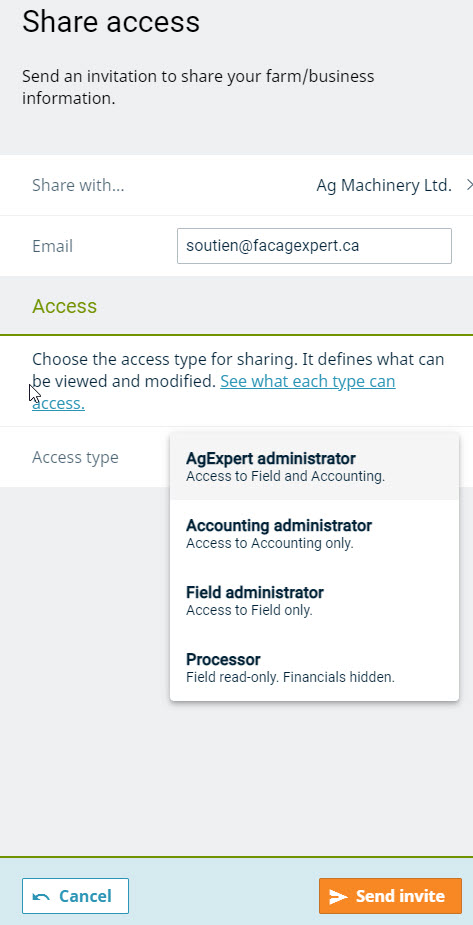

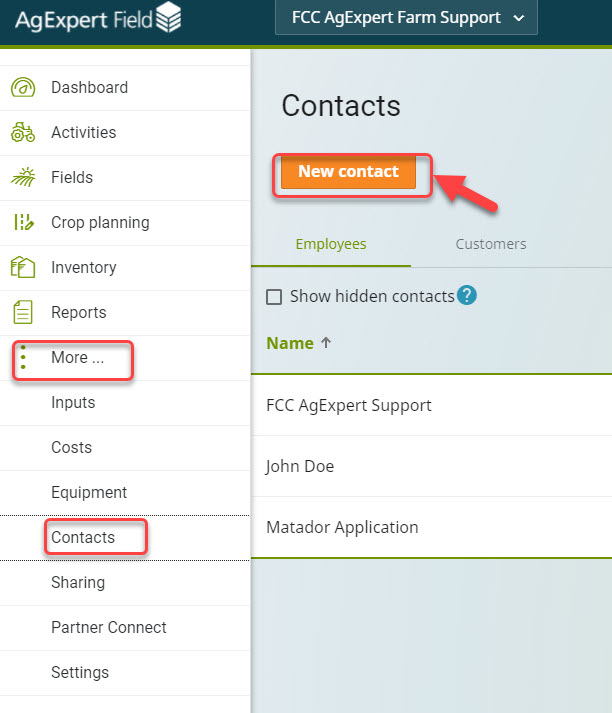

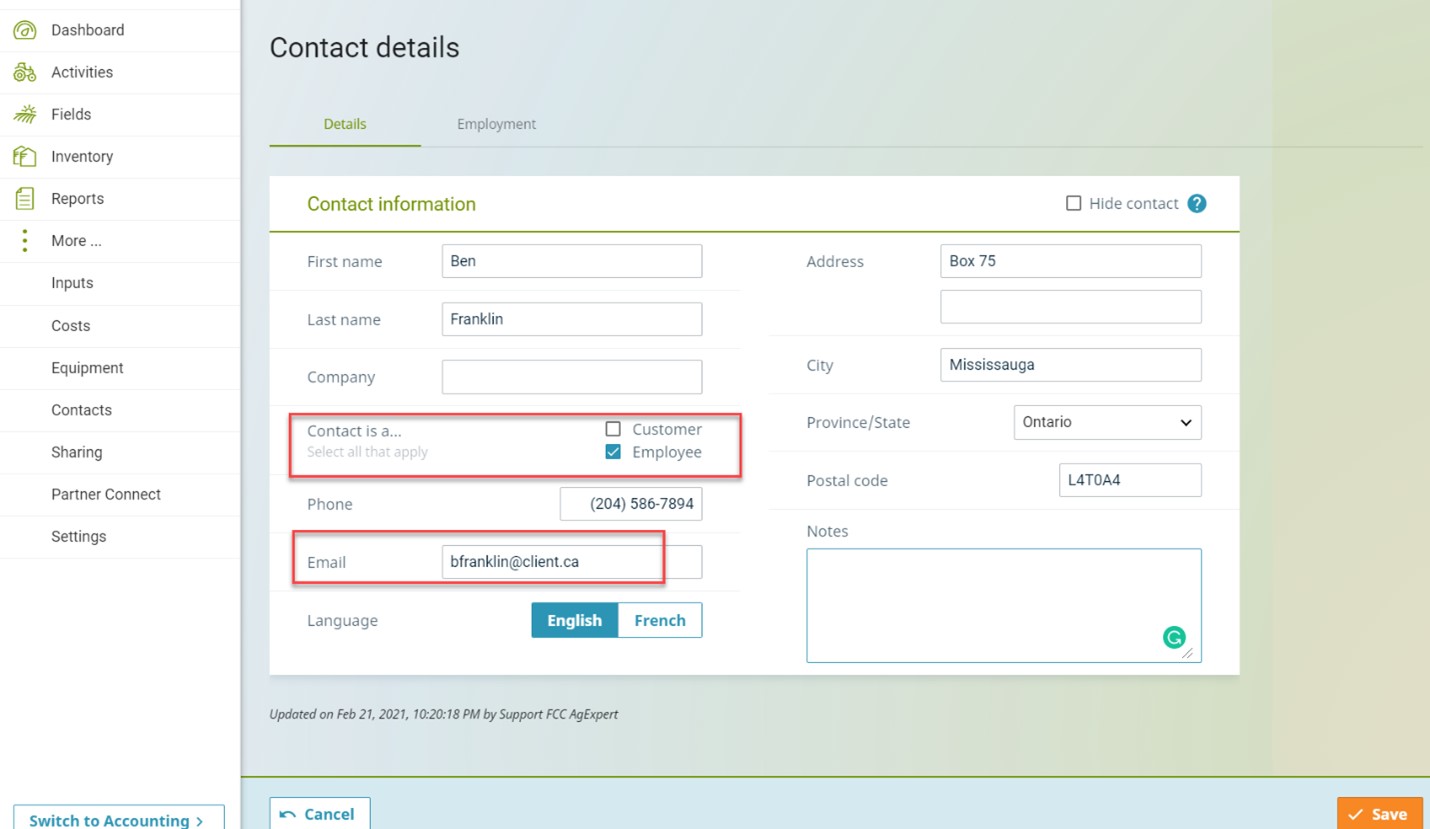

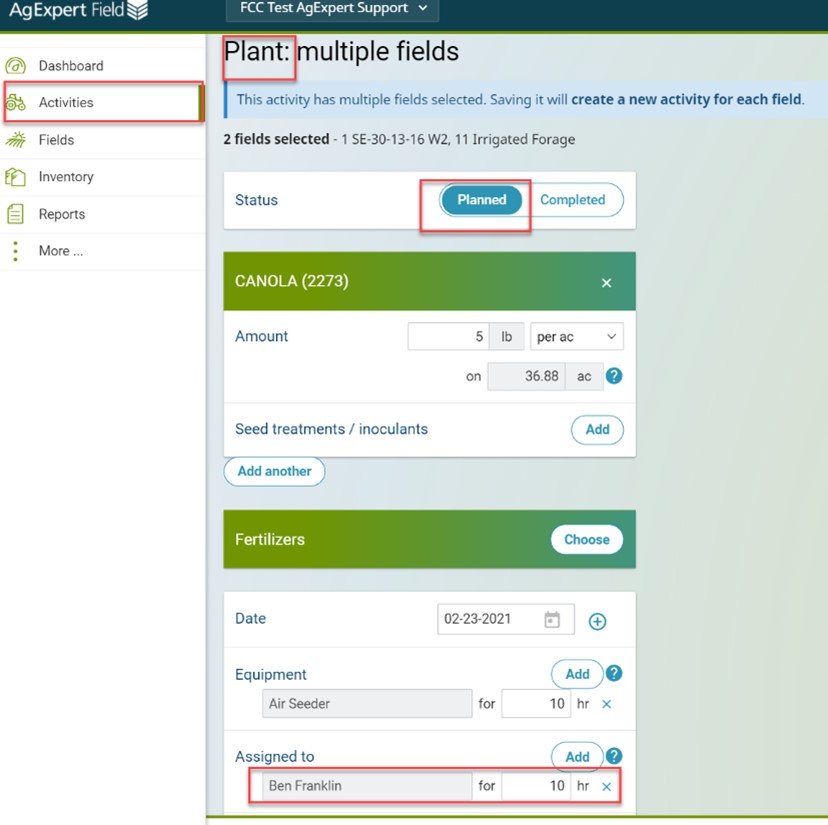

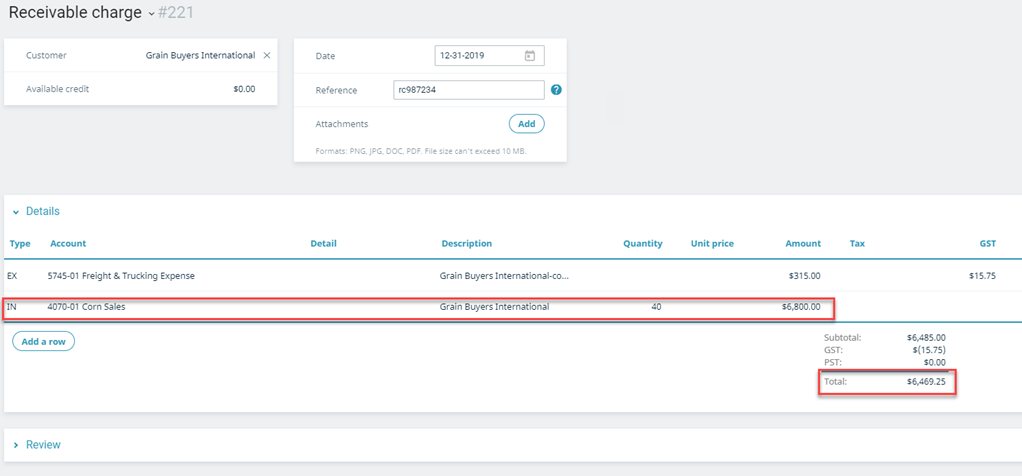

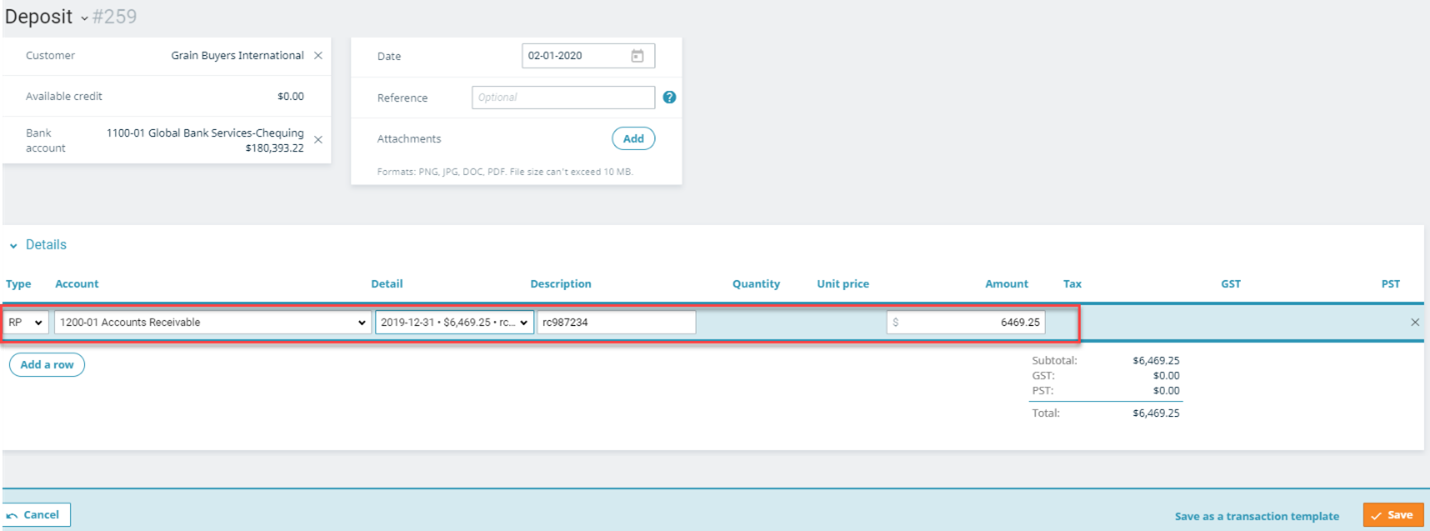

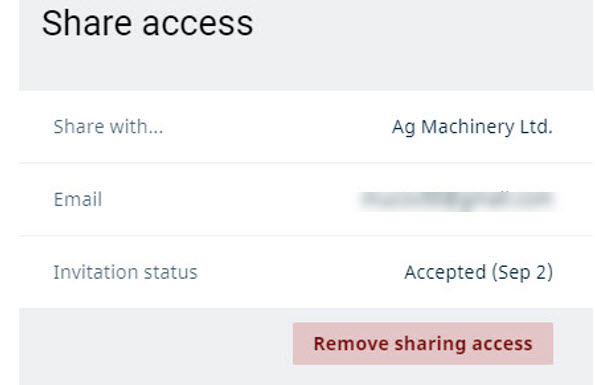

There’s no need to share your credentials. With a Premium subscription to AgExpert Field or Accounting, you can simply invite contacts into your accounts. This way, you control who has access to your data.

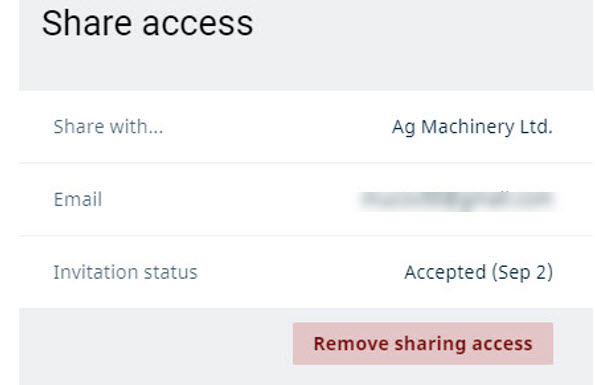

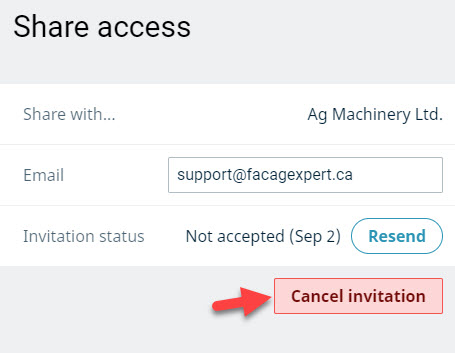

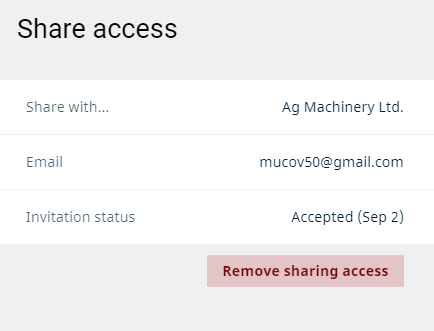

Remove sharing any time – regularly revisit the list of people you’ve shared your data with. If they don’t need access to your books anymore, remove them from your account.

Learn more about securely sharing your AgExpert data.

Create strong passwords

When you create your account, choose strong credentials. This will protect your account and help prevent it from being hacked, highjacked or compromised.

- Use strong and unique passwords of at least 8 characters ideally including letters, numbers and symbols.

- And of course, keep your password confidential.

Sign out of your account

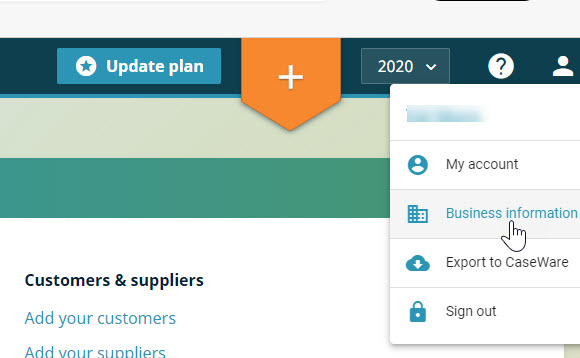

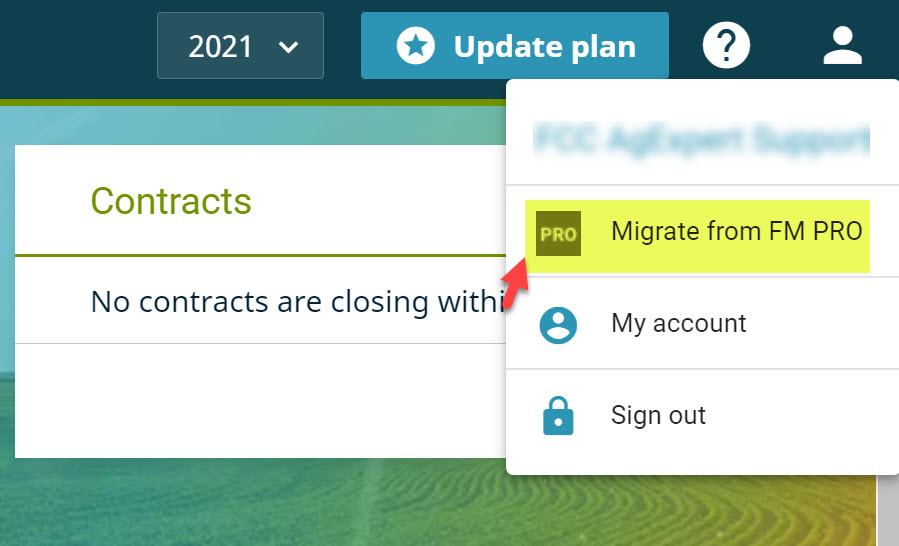

Make sure to press the “Sign Out” button at the end of every session. Yep, EVERY session. This important step (that many of us forget) can help protect your information.

Use updated technology

AgExpert regularly releases program updates to address security issues and fix minor bugs that may occur. Everything works best when your system is updated with the latest version of your internet browsers; Chrome or Edge work best with AgExpert Field and Accounting software.

All devices use software that occasionally needs to be updated, so don’t keep ignoring those update notifications.

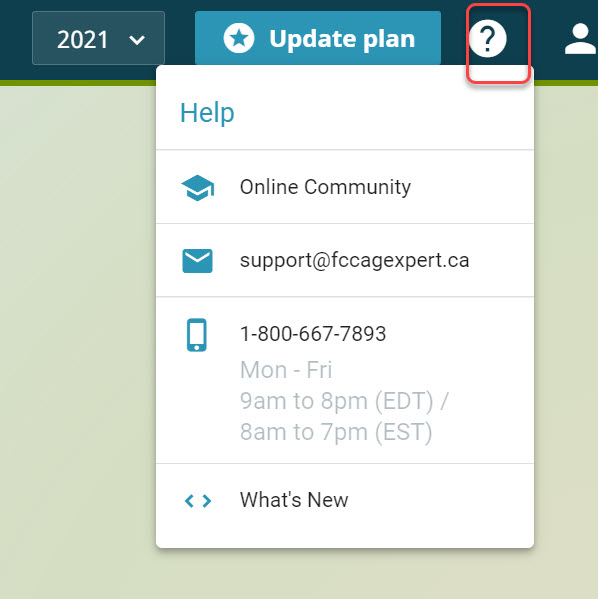

Questions about protecting your AgExpert data? Email info@fccagexpert.ca or call us at 1-800-667-7893.

Wednesday, September 14, 2022 at 10:31AM

Wednesday, September 14, 2022 at 10:31AM